Summary:

– Bankers’ New Clothes is a useful book in that it makes clearly the case for higher equity requirements for banks. This does seem a much sensible path than separating ill-defined activities.

– The book does however fail to account for the difference between US and EU financial systems. As a consequence, significant costs of higher equity requirements are overlooked. The criticism of risk-weighted assets is unconvincing.

Disclaimer: Author works for a major European bank. All opinions expressed here are purely its own.

Anat Admati and Martin Hellwig’s core point in Bankers’ New Clothes is a simple one. There is one and only one way to reform the banking system and reduce the risk of devastating crises such as the one we have just experienced: to require banks to have more equity. This position is well-researched, backed by reliable experts (Paul Volker, Erkki Liikanen, Sir John Vickers to name only a few). Influential research papers have been pointing this way of late.

BNC, however, attempts to be more than a well-documented and accessible statement of this position. The aim of the authors is to dismantle the arguments bankers use to resist the push for financial reform in general and higher equity requirements in particular. This attempt is partly successful, and partly a failure. Their demonstration is accurate when they draw sharp distinctions between the interest of banks and those of society in general, showing that even reforms that are costly to banks may be beneficial to society. They are less convincing when their narrowly US-centric point of view gets them to defend positions that are identical to those of US banks against the Basel framework.

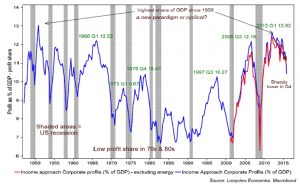

Let us start by what is good in this book. It provides an easily understandable introduction to how the banking system functions. It demystifies many technical terms such as leverage, options, bank capital and so on. BNC puts forward, in a consistent and convincing manner, why one can think that banks must be held to much higher equity requirements. They successfully dismiss talks of structural reforms (return to a Glass-Steagall, Liikanen, Vickers and so on) as ineffectual. Financial crises are not an effect of bank structure, but of a fragility of the banking system itself, and the only buffer is bank capital (or equity), which was at an all-time low (in the 3% of total assets) in the run-up of the 2007 crisis. We will not discuss this point here: the optimal level of capital is the object of much debate, but it does seem that the socially optimal level would be higher than what is required y current regulation. For the authors, the proper level of equity to total assets would be in the 25% – 50% range (and possibly higher) where Basel III sets that ratio à 3% (and mainly as a backstop to the equity to risk-weighted assets ratio.

Things start to go awry when the authors claim that a rapid move towards high equity levels would be almost costless to society. We are always suspicious of free lunches. And we do believe that this is indeed no free lunch for society. To understand how BNC misses the trade-off, one must go into some unspoken assumptions and biases in the book. We will focus on two points:

– Bankers say that equity is more expensive than debt, and thus higher equity requirement would decrease lending, thus adversely impacting economic activity. BNC says this claim is false, since higher equity means safer banks, which turns into a lower risk premium on equity (a.k.a. The Modigliani-Miller theorem).

– European banks say they are at least as well-capitalized as US banks. BNC says this is false, EU banks using unreliable risk-weighted capital ratios instead of ratios to total assets.

Our objections to both points have a common root: BNC fails to account for the deep differences between the US and the EU. That failure makes it blind to why their proposed solutions would not work.

Increasing equity is indeed expensive

Let us take the claim that equity is more expensive than debt. BNC does recognize (but downplays) the importance of the tax wedge: debt repayments are not taxed, but dividends are (and sometimes twice), thereby providing a powerful incentive to debt funding. Absent that tax wedge, Modigliani-Miller should apply: a bank with more equity would be safer, and shareholders would require lower dividends as a result. So, why are banks resisting so vehemently higher capital requirements?

A recent (and much cited) article (David Miles, Jing Yang, Gilberto Marcheggiano: “Optimal Bank Capital ») shows that the M-M theorem does work, but imperfectly. Using historical data, they show that one-third to one half of the expected lower returns requirements on equity do not materialize. This effect may be even bigger in a context where people are wary of banks and of investing in stocks as a whole. This is just the case in general, and in Europe in particular.

BNCseem to completely ignore that the investor landscape in Europe is not the same as in the US. Because of large public pension systems and reasonable healthcare cost and coverage, pension funds and insurers are much smaller than in the US, by several orders of magnitude. This means that there is simply less capital around (pay-as-you-go pension systems do not accumulate capital) and that it would be difficult (costly) for a bank to make large equity issuances. The problem is magnified by a composition effect (which BNC completely overlooks): even if one bank could raise more equity quickly, it is safe to think that all banks trying to do so at the same time would well exceed demand, leading to lower prices (ie expensive equity).

BNC makes a point that return on equity requirements should fall if the level of risk of banks decrease. In a perfect world, they should. In the current circumstances, we rather doubt it. Pension funds are significant investors in US banks. Those funds are currently in a quandary: they promised high returns (around 8%) when yields were high, and must now face that promise as yields on bonds are at an all-time low and they have little room to go to high-yield, high-risk assets. This means that even with a lower risk level, they may want to keep their ROE requirements: they need 10% – 15% of ROE just to keep their financial equilibrium.

A simple fact should have raised doubt on the idea that, faced higher requirements, banks would in fact comply by increasing equity: in recent year, we have witnessed a very large deleveraging of the EU banking sector in order to achieve Basel III capital ratios. If raising equity were indeed not that costly, why would have banks sold assets at depressed prices? This points to the fact that the risk of a credit crunch if equity requirements are implemented too quickly is real, not just an article of lobbying. When constrained, banks do cut credit and not just raise more equity.

While costly equity is a problem for banks, lower credit is a social cost. When funding costs increase, marginal projects cannot get funded, which is detrimental to activity. This effect comes over and above other distortions in bank lending underlined by the authors.

Of accounting and risk-weighted assets

The second point come whenever BNC compares US and EU banks. For several reasons, this is an apple-to-oranges exercise. The authors are partly aware of that. For example, a figure in the book (6.1) show how the US accounting standards (GAAP) vastly reduces banks’ balance sheets compared with the EU’s IFRS, by allowing the netting of derivative positions. They use that to show that the capital ratios of US banks would be lower under IFRS. Strangely enough, they forget that point several chapter later, when their target is the Basel framework. They claim there that EU banks have lower capital ratio than US ones. This is doubly a misrepresentation.

Firstly because of the difference of accounting: if computed under GAAP, EU banks would have the same level of leverage as their American counterparts (the case of Deutsche Bank, who publishes accounts under both systems, is a proof, as illustrated in Arroyo et al., 2012).

Secondly, the business models are very different, making leverage comparisons meaningless. In the US, pensions funds and institutional investors as well as the Glass-Steagall legacy generate a high demand for bonds. Banks have an originate-to-distribute model: they originate loans, and resell them in the form of bonds, keeping only a part of the riskier tranches in order to have some skin in the game. In the EU, there is much less appetite for bonds. Banks usually keep the whole loans on their balance sheet, resulting in higher but much less risky assets. Not accounting for that business model difference vitiates any comparison of leverage ratios.

Nowhere is this lack of understanding more evident than in the part devoted to the Basel framework and risk-weighted assets. Whole the book claims to be critical of bankers’ arguments, it simply looks like a page off US banks’ lobbying manual. The very public and vocal disagreements between US and EU banks should have raised several red flags: the bashing of the Basel framework by US banks is indeed self-serving.

Because of the originate-do-distribute vs originate-and-hold differences, US and EU banks have very different levels of risks in their assets. Accounting for that risk, ie using risk-weighted assets, would be very costly to US banks, who keep the riskier parts of structured transactions, when compared to the portfolio of large corporate and sovereign bonds and loans that are held by EU banks. NBC also misses whey risk-weights were introduced in the first place. With a simple leverage ratio, two banks with $100M assets and $20M equity are equally capitalized, and deemed equally safe. This is obviously misleading if one the banks have lots of speculative investments while the other has mainly US bonds in its portfolio. Using unweighted leverage thus provides a large incentive to concentrate on riskier assets for a given level of capital, and this is the very reason risk weight have been introduced in the first place (and so strongly resisted by US banks).

The RWA system does has its flaws, and the current regulatory portfolio reviews are exposing them. But advocating to simply scrape it in favor of an unweighted leverage ratio is unwise.

Blame where it is due

The third bias of the book is that on its intention of heap blame on the banks (and their regulators), it oversees other responsibilities. For example, BNC bashes Basel for risk-weighting all EU sovereign debt at 0% (riskless). This was not however the result of bank lobbying, but that of sovereigns themselves. They used that lever to secure cheap funding, at the expense of banks. Similarly, it is not the banks that rated AAA subprime senior tranches, but rating agencies, strangely absent of the picture in the book.We would not subscribe completely to the regulatory capture. During the crisis, regulators seem to have been more overwhelmed by the sheer dimension of the problems than anything else.

Conclusion

Let us be clear: We do believe that higher capital requirements would indeed increase the resilience of the banking system. We do think that now is the time where there is enough political will to push these requirements through. We do however believe that implementing them too quickly would be tremendously costly not only to banks, but to the economy as a whole. It would be far better to commit to a long-term, gradual march towards higher ratios. A condition for that is that US and EU banks manage to harmonize their accounting and regulatory environment.

References

– Anat Admati and Martin Hellwig, The Bankers’ New Clothes: What’s Wrong With Banking and What to Do About It,Princeton University Press, 24/02/2013, ISBN-13: 978-0691156842, http://bankersnewclothes.com/

– José María Arroyo, Ignacio Colomer, Raúl García-Baena and Luis González-Mosquera, “Comparing Risk-Weighted Assets: The Importance of Supervisory Validation Process”, Estabilidad Financiera, Banco de España, 22, 2012

– David Miles, Jing Yang, Gilberto Marcheggiano, « Optimal Bank Capital » 6 juin 2012 DOI: 10.1111/j.1468-0297.2012.02521.x, The Economic Journal Volume 123, Issue 567, pages 1–37, March 2013)